So when comparing YNAB vs Mint, which one wins? In this case, there’s actually a very clear winner.

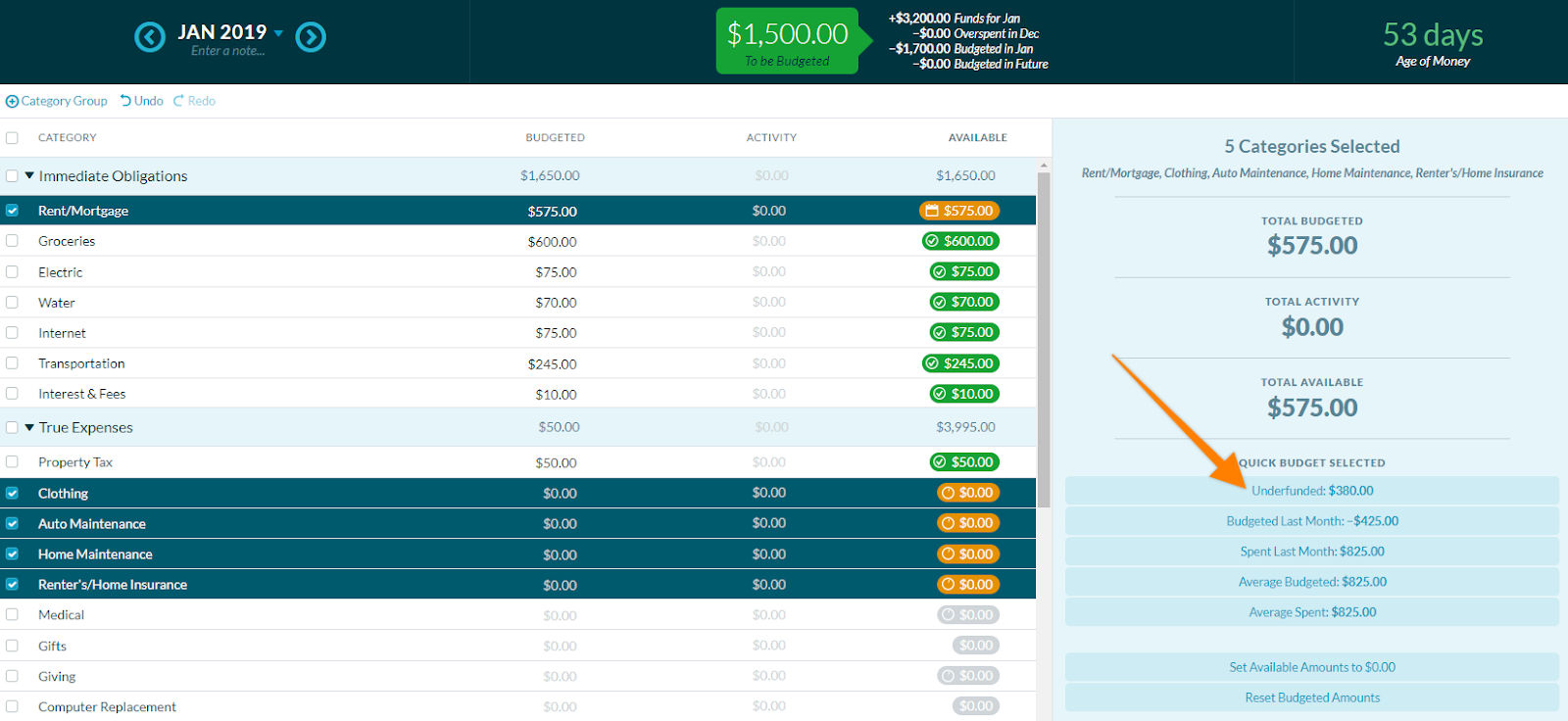

Assigning incoming funds to budget categories feels like you’re actually spending that money, which forces you to be more realistic about your spending.It forces you to control spending in your categories (like dining out) so that you don’t have to “steal” money from other categories that are important to you (like saving for a car).What you’ll notice is that the end result of YNAB is this: You’ll actually need to cover this overspending by either assigning more “To be Budgeted” money to it (if you have any left), or reassigning funds from other budgeted categories. If you overspend in a category, you’ll see that in red. This is where YNAB gets very interesting. You’ll need to go down the list of your budget items and assign pieces of those “To be Budgeted” funds to each budget item that is due the soonest. “To be Budgeted” gets loaded with more funds any time you receive a paycheck or any kind of positive cash flow into your bank account. The YNAB approach is that you’ll only plan out your spending as far into the future as you can with the cash you currently have on hand. If you’re expecting to “assign” a monthly amount to each budget item at the start of the month, you’re going to have to relearn everything you’ve ever thought about making a budget. This is especially the case if you’ve always used the old-school monthly budgeting approach. Making a budget in YNAB is going to set your head spinning at first. Overall, the budgeting interface and process is complicated and time consuming.The bill notification emails from Mint can get annoying if you don’t turn them off.Handling unexpected expenses in Mint is difficult and adds to your financial planning stress.Mint tends to induce a lot of guilt since overspending on budget items is often inevitable.You’ll see which budget items you’ve overspent on each month.You’ll know when your overall spending is getting out of hand before the end of the month.What you’ll notice is that the end result of Mint is this:

0 kommentar(er)

0 kommentar(er)